Understanding Bitcoin and the Bitcoin Ecosystem

Bitcoin is a digital currency created in 2009 by a software developer named Satoshi Nakamoto. The introduction of Bitcoin coincided with the global financial crisis when many people were losing faith in banking institutions. This post focuses on understanding Bitcoin and the Bitcoin ecosystem.

Bitcoin Isn’t a Physical Coin

In other words, you can’t hold Bitcoin in your hand. Bitcoin is an electronic representation of money – digital currency. A digital currency can be used to buy items electronically – like using a credit card to buy an item on the internet.

Bitcoin is one form of digital currency that we’ll refer to as cryptocurrency or “crypto” for short. Cryptocurrencies rely on cryptography to keep the ecosystem secure.

If Bitcoin had just been a simple digital cryptocurrency, it may have remained on the fringe of the internet. Instead, it has increased from fractions of a cent when it started to over $1000 ($18,000) dollars US [in 12/15/2017] and is now around $8000 (November 2019).

What Makes Bitcoin Interesting?

To understand Bitcoin, we need to start with understanding what Bitcoin offers that credit cards and cash don’t. There are many reasons that Bitcoin has captured people’s interest including:

- Bitcoin is a decentralized cryptocurrency

- Bitcoin has a limited # of coins

- Bitcoin transactions are transparent

- Bitcoin transactions are anonymous

- Bitcoin transactions can’t be changed after they’re in the blockchain

Decentralized Currency

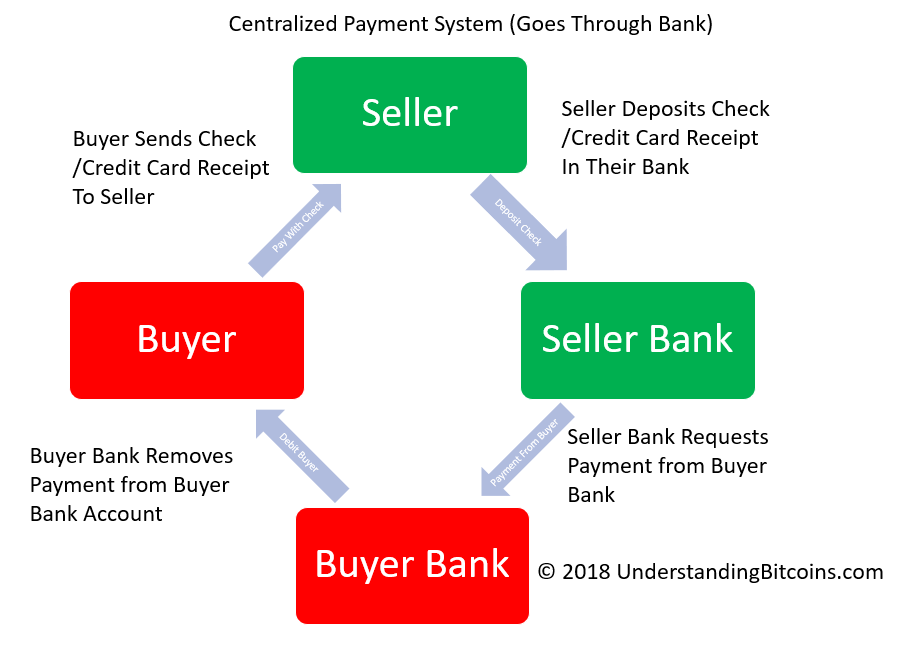

Traditionally, countries used banks to create and regulate currencies. To send money to someone, a person sends a check or promissory note and the recipient would cash the check at the bank.

The recipient’s bank would then request money from the sender’s bank. Since the money transfer needs to go through the bank system, the money supply is considered “centralized”. The bank handles the money transfers.

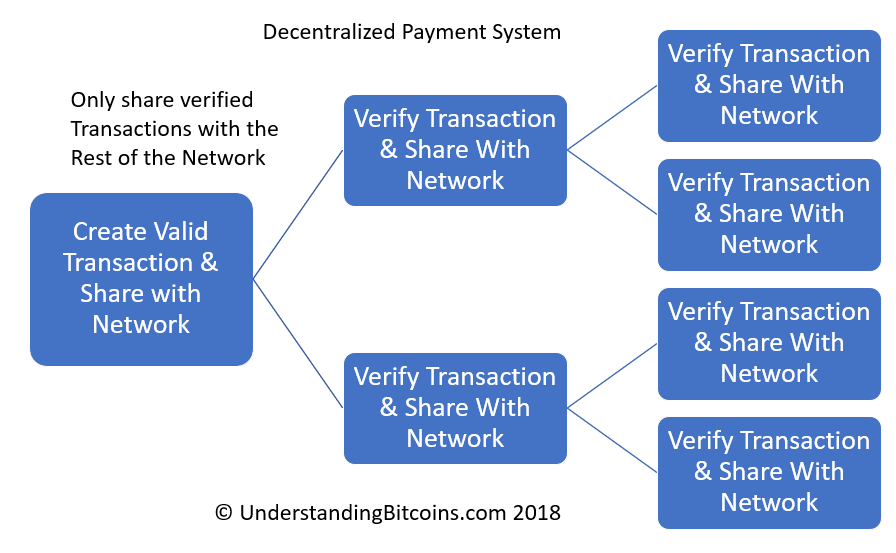

What if computers could determine a purchase or sale was valid? You wouldn’t need a bank in this case. Using technology to certify a transaction is the main idea behind Bitcoin. Each transaction is broadcast to all the computers to the Bitcoin network. This group of computers (sometimes called peer-to-peer (P2P) networks) share Bitcoin transactions with each other.

These peers also check the cryptocurrency transactions. Since anyone can become part of the Bitcoin network there is NO main computer. Anyone can become a peer on the Bitcoin network. The lack of a main computer/person is referred to as de-centralized since there is no central authority or issuer.

Limited Bitcoins

There is a limit to how many Bitcoin can be created. Only 21 million Bitcoins will be created and is guaranteed by the Bitcoin software. Bitcoin is less likely to become worthless from overproduction like fiat money which can be printed anytime the government decides.

Fiat money refers to the dollars and euros that countries currently use. New Bitcoins are created about every 10 minutes but the number of Bitcoin created decreases with time.

Transparency

The Bitcoin algorithm and software is open source – meaning it is available for anyone to download and look at. Additionally, since Bitcoin transactions are shared with the peer-to-peer network, anyone can look at any transaction – even going back to the beginning of Bitcoin.

One good place to see the current Bitcoin transactions is the Blockchain.info website. Looking at the blockchain is a great way to gain more insight when learning to understand Bitcoin.

Transactions are stored in a format known as the Bitcoin blockchain. Think of the blockchain as the record of each transaction. The Bitcoin blockchain is similar to an accounting ledger used to record payments and receipts. More information can be found on our on How Bitcoin Transactions Work page.

Anonymity

Unique codes are used to identify the sender and receiver. If the private and public keys aren’t shared with others, the sender and receiver remain anonymous.

Since the chain of transactions can be traced through the blockchain, someone wanting to stay anonymous needs to be careful not to leak information. If you cash out the Bitcoin at an exchange that includes your real name and address, the chain can be followed.

There are other cryptocurrencies such as Zcash, Monero or Dash that do a better job of keeping users anonymous.

Transactions are Permanent

Once the blockchain records a transaction, that transaction can’t be changed. The reason is that the outputs of each transaction are “chained” together. The output of the previous transaction (that occurred ~10 minutes ago) become part of the current transaction.

Changing an old transaction would require changing all the transactions since that transaction. Since copies of the blockchain reside on many different computers, everyone’s blockchains would need to be changed as well.

One way to picture this is as a brick wall. A clean blockchain would look like this. Imagine a bad blockchain as this wall with a missing brick.

There are no chargebacks in Bitcoin technologhy. Unlike credit cards, once the coins are sent, the coins can’t be returned to the sender. If a charge is disputed and it is determined the coins need to be returned, a new transaction will have to be created because the blockchain can’t be changed.

Remember how Jenga works?

Where Does Bitcoin Come From?

Bitcoin are generated by a process known as Bitcoin mining. People called “miners” on the Bitcoin network use CPU or GPU power on computers to solve a mathematical puzzle. Everyone on the Bitcoin network races to solve the puzzle first. The miner who solves the puzzle is rewarded with new Bitcoin cryptocurrency for their effort.

The winning miner also creates the next block in the blockchain. The new block includes the transactions that have occurred since the last block (approximately 10 minutes ago). This new block includes a reference to the previous block (a chain of blocks or “blockchain”). In addition to the rewarded Bitcoins, the winner also gets a fee for adding the accumulated transactions into the block they created.

Then the winning miner publishes their new block to the Bitcoin network where other miners verify it. The puzzles are hard to solve but easy to verify so this happens quickly. Once it is verified, it becomes part of the Blockchain and the next block will include a reference to this newly created block.

Exchanges have been created to make it easier for miners and users to buy and sell their Bitcoin. Exchanges are similar to stock brokerage sites where company stocks or mutual funds can be acquired. At exchanges Bitcoin can be exchanged into traditional fiat currencies such as the Dollar or Euro or even virtual world currencies such as the Linden dollar.

How are Bitcoin sent or received?

Private and Public Keys

Since Bitcoins are digital currency, they need a secure way to be sent and received. Each owner has a private key that is stored in a digital wallet. Each user also has a public key. These keys come in pairs and can be used to encrypt and decrypt data.

For instance, “This is a test” might be encrypted using the private key to this:

AC34sj1P9t7Y4rs5wEDC2w33g6

And then sent to a friend. If the friend has the public key, they can decode the text back to “This is a test.” This also allows them to “verify the message is from you” since a different private key wouldn’t encrypt the message in the way that the matching public key could decrypt.

The cool thing is that it works the other way too! The friend can use your public key to encode their own message, send it to you and your private key can decrypt their message.

A bitcoin address is hashed from a public address resulting in a bitcoin address that looks like this:

35FUAFsAAR5jcQ9MtTTDqqyDbwjRMHttKR

Using Keys in Bitcoin

Private and public keys are the “magic” of Bitcoin and are the hardest part of understanding Bitcoin. To send a Bitcoin transaction, the sender needs the Bitcoin address of the receiver. The Bitcoin address is an encoded form of one of the receiver’s public keys.

An example of a valid bitcoin address is 35FUAFsAAR5jcQ9MtTTDqqyDbwjRMHttKR.

To spend the Bitcoin, the sender must provide these things.

- The source of the Bitcoins to verify the amount of funds are available. These are referred to as “inputs”.

- You can’t send 10 bitcoin to someone if you only own 5 bitcoins. There can be many inputs but they need to add up to the amount of bitcoins being sent.

- The amount of Bitcoin being sent to the receiver. These are referred to as “outputs”.

- The sender’s public key.

- A “signature” which is signed by the sender’s private key.

The transaction is verified by the miners. The miners verify the public key can decode the “inputs” and verify the sender’s signature. If both of these are valid, this miner has validated the sender and the transaction will be included in the block and added to the blockchain.

These funds are then available to the receiver. To spend this bitcoin later, the receiver will reference this transaction as their “inputs”

How To Get Started In Bitcoin

Digital Wallet

A wallet app on your computer, a hardware wallet, or in a third party wallet can be used to store Bitcoins. Anyone with a Bitcoin address created by the wallet can exchange coins. The transactions use digital signatures from the wallet to ensure they are only spent once and by the person who owns them.

Buy Bitcoin from a Friend

Bitcoin is easily sent from person to person. First, the receiver creates a new Bitcoin address in their wallet. Next, the sender sends the Bitcoin to the receiver’s wallet using this address. This is like using an email address to send a note to a friend.

One website connecting buyers and sellers is localbitcoin.com.

Buying Bitcoins on an Exchange

The easiest way to get started with Bitcoin is to purchase coins from a Bitcoin exchange. This is similar to setting up a stock brokerage account.

Often you can buy a small amount of bitcoin with a credit or debit card. For larger amounts, the exchange may require a link to your checking account. Crypto exchanges are now a part of the finance world so expect some of the same verification requirements as for stock brokerage accounts.

Mining Bitcoin

You can download and install what is called a Bitcoin client on a computer to get started generating and trading Bitcoins. This will give you the Bitcoin wallet and an address.

High profits have resulted in some large mining farms using large numbers of computers to try to solve the puzzle. It is unlikely a single computer will be lucky enough to solve the math problem.

To compete against these large farms, many small miners join together to “pool” their resources and avoid competing with each other. When a pool solves the puzzle, the pool shares the reward with all the miners in the pool.

What is the Worst That Could Happen?

There are some failure scenarios for Bitcoins. These include a currency devaluation, a declining user base and a global government crackdown on the software and exchanges.

Conclusion

Hopefully, this post covered the basics of Bitcoin explained simply. Bitcoins are a true 21st century currency. If you want to see how currencies of the future work, download the Bitcoin client and start mining and trading today.